Looking for some extra cash? If you currently have a qualifying loan with North Central, you may have the opportunity to skip a payment once per year.

Eligibility:

- Closed-end installment loans (Note – Real Estate Loans and Credit Cards do not qualify)

- Loan can’t be delinquent for seven days or more

- Loan can’t be delinquent four times or more over the life of the loan

- Account open for six months

- Account can’t be over limit

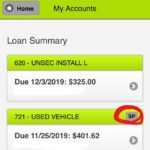

If you qualify, look for the Skip A Pay button in the online banking to initiate the Skip. If you do not see this button appear in online banking, call the credit union so we can assist you.

*Note: If you don’t see the option to skip, your loan may not be currently eligible. To initiate the skip, a will be applied to each payment skipped, fee will be taken from your 000 account, see fee schedule. The loan must be at least six months old, with no late payments (seven days past due or delinquent more than four times over the life of the loan), or granted forbearance requests within the last 12 months. Qualifying loans include fixed-rate and fixed-term loans. Credit cards, real estate, and any other lines of credit are not eligible.

By requesting a Skip-A-Payment, you are requesting NCACU to advance the loan due date equal to one month’s payment. You understand that the current balance of the loan is extended by the amount of the payment skipped, and that interest will continue to accrue on your loan balance throughout the deferred payment period, which may further extend the term of your loan. If there is more than one borrower on a loan, only one borrower is required to authorize a Skip-A-Payment. Contact the credit union for details. Other restrictions may apply.