Activate. Earn. Repeat.

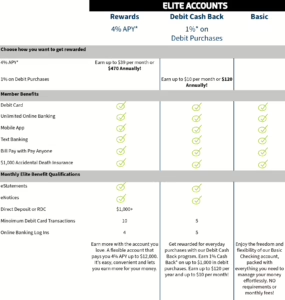

Your Elite card is your access pass to our premium checking family. Choose how you want to be rewarded with picking an Elite Checking tier upfront.

Simplify spending and start earning today!

Already have an NCACU Checking Account and want to be Elite?

Contact the credit union to get it added today!

COMING SOON: A New Look to Your Elite Debit Card!

What NCACU employees are saying about the new card:

“When I think elite card, I think black.”

“I like that our colors are incorporated in the design,”

“Classyyy.”

Reward yourself with an NCACU Checking account, which includes the following benefits:

*APY = Annual Percentage Yield. Terms and limitations apply. Rate as of January 1, 2026, and subject to change after account opening. $5 membership required. No minimum balance required. Monthly requirements must occur by the end of the day on the last day of the month. Overdraft/returned item fees may apply.

Elite Status can change month to month according to their transactions and monthly lifestyle in the preferred and chosen tier.

Rewards Checking– Members may earn 4% APY. Purchases do not include ATM transactions. Credit or Debit card purchase requirements are based on merchant preference. Dividends are not paid on balances over $12,000. Dividends are not paid if requirements are not met. Fees may reduce earnings. Requirements: Direct Deposit at least $1,000 monthly into your Checking account or Remote Deposit Capture (RDC), minimum of 10 debit card signature-based transactions per month, minimum of four logins to online banking per month, opt into eStatements and eNotices.

Debit Cash Back– Members may earn 1% Cash Back up to $10 on qualifying debit card purchases per month, posted monthly as a single deposit on the last day of the month. Cash Back is calculated based on a percentage of the total amount of spending performed by the member during the month on eligible debit card purchases. Your Debit Cash Back Account must be open when debit card Cash Back is posted. Requirements: opt in to eStatements and eNotices, five or more Online Banking logins per month, five or more signature-based transactions per month.

Courtesy pay is not available for any member under the age of 18. A minimum of one parent/guardian will be joint on the account to qualify for a checking account if under the age of 18. Qualifying debit card purchases include: Point-of-sale purchases made with your debit card; and Online purchases made with your debit card. Debit card transactions that are not eligible for 1% cash back include: Transactions conducted at an ATM; The purchase of money orders, currency, coins, or other cash-equivalents, such as Bitcoins, negotiable items not yet deposited, U.S. treasury bills, and commercial paper; Peer-to-Peer or Person-to-Person (P2P) payments; Merchant returns/refunds. See credit union for details.

CD bonus rate of .25%APY requires $250 in direct deposit per month, a valid email address on file, enrolled in eStatements, eNotices and Online Banking. Members need to be enrolled by NCACU staff. Status can change month to month according to requirements being met. Prorated dividends are posted as a separate dividend to the CD on the first day of the month. Monthly requirements must occur by end of day the last day of the month. Penalties for early withdrawal will impact earnings. Minimum CD investment is $500. Maximum investment is $250,000. The deposit amount determines the dividend rate for your Certificate of Deposit (CD). See credit union for details

Loan Rate discount of .50%APR (Annual Percentage Rate) requires a minimum of $1,000 Direct Deposit monthly into an Elite Checking, an active Debit Card, four Online Banking log ins, a valid email address on file, and enrolled in eStatements and eNotices. Members need to be enrolled by NCACU staff. Status can change month to month according to requirements being met. Participation is optional and does not affect credit approval. Discount credit is applied to loan’s principal balance on the last day of the month in which qualifications were met in the month prior. See credit union for details.