Home Buyer Edition

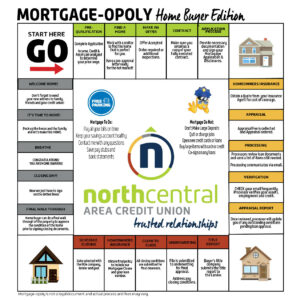

Buying a home can often feel like playing a complex game of Monopoly, where strategic decisions lead to the ultimate reward of homeownership. At North Central Area Credit Union, we’re here to guide you through this exciting process, from the initial roll of the dice in prequalification to the successful placement of your own ‘hotel’ on Boardwalk.

Here’s a step-by-step breakdown of Mortgage-opoly, designed to help you navigate the home-buying adventure:

- Prequalification: This initial step involves completing an application that analyzes your income, credit, and assets. It’s crucial as it determines your price range, setting the stage for a focused and realistic home search. Think of it as laying the groundwork in this game of Mortgage-poly, where knowing your budget is critical to plotting your next move!

- Find A Home: Partnering with a realtor, you embark on a journey to find a home that ticks all your boxes. Armed with a pre-approval letter, you’re a step ahead in the competitive market, much like having a ‘Get Out of Jail Free’ card that shows sellers you’re a serious contender.

- Make An Offer: Once you’ve found your dream home, it’s time to make an offer. If accepted, you’ll proceed to order the necessary inspections.

- Contract: Sending us a copy of your fully executed contract moves you into the next phase. It’s the equivalent of securing a prime piece of real estate on the board, setting the foundation for your future moves.

- Application Process: Providing the necessary documentation and signing your mortgage application and disclosures further strengthens your commitment to the home-buying process. It’s a critical step, like deciding which properties to build houses and hotels while planning for long-term success.

- Homeowner’s Insurance: Securing a quote for homeowner’s insurance is similar to buying an insurance policy in the game. It protects your investment against unforeseen events and ensures you’re covered as you advance towards ownership.

- Appraisal: The appraisal determines the property’s value, ensuring the investment is sound. Paying for an appraisal is like assessing the value of a property you’re interested in purchasing on the board.

- Processing: A loan processor will review your documents and request any additional items, keeping the game in motion. Their regular communication via email is essential, similar to the game’s rules that guide players’ actions and strategies.

- Verification: Regular email checks are crucial as your loan processor verifies your financial details. Staying engaged and responsive reflects the attention needed to navigate the game’s twists and turns successfully.

- Appraisal Report: Reviewing the appraisal report is next. It updates you on any conditions that must be met before loan approval. It’s comparable to evaluating your assets before making a significant play.

- Title Report: The title company’s submission of the title report to the lender is pivotal. It ensures the property’s title is clear and transferable, much like verifying the ownership of a property on the game board.

- Underwriting: Final approval comes from underwriting, where your file is thoroughly reviewed. Addressing any closing conditions now is like the final rounds of negotiation before clinching a deal.

- Clear to Close: Achieving ‘Clear to Close’ status means all conditions have been met. It’s the final stretch before ownership, just like reaching the last few squares of the Monopoly Board.

- Schedule Closing: Coordinating the closing date involves aligning schedules with the title company and lender to complete the final transaction.

- Final Walk-Through: This is your opportunity to ensure the property is in the agreed condition before the final agreement, much like a final assessment of assets before declaring victory.

- Closing Day: Signing the closing documents cements your homeownership, the ultimate goal in the home-buying process.

- Breathe: Congratulations are in order! Taking a moment to breathe and celebrate reaching this milestone is well-deserved.

- It’s Time To Move: Packing and moving symbolize the beginning of a new chapter in your home, much like the anticipation of a new game.

- Welcome Home: Finally, updating your address with family, friends, and the credit union marks the start of many new memories in your new home, similar to the pride of winning the board game and starting anew.

Much like a game of Monopoly, your journey involves strategic planning, critical decisions, and a bit of good fortune. At NCACU, we’re here to guide you through each step, ensuring your path to homeownership is as smooth and rewarding as possible.

To learn more or get started on the game of Home Ownership, contact Ed, our Mortgage Specialist, at (616) 340-3014.

We can’t wait to welcome you home!